January 20, 2024|Education by Design

As a society, we often overlook the importance of teaching financial literacy to children. However, with the increasing complexity of the financial world and the growing debt crisis of over thirty four trillion, it is becoming more urgent than ever to ensure that children learn the basics of personal finance. Debt and inflation continues to eat away at their future and our youth need knowledge to help them prepare. Simply encouraging children to save is not going to cut it. By providing children with a solid foundation in financial literacy, we can help them make informed decisions, avoid consumer debt, and build a secure financial future.

Financial literacy is not just about understanding how to save money or balance a budget. It encompasses a wide range of skills, including understanding credit and debt, managing investments, and making informed decisions about spending. Unfortunately, many children are not taught these skills in school or at home, leaving them vulnerable to financial pitfalls and scams. By prioritizing financial literacy for children, we can help them build a strong financial foundation that will serve them well throughout their lives.

Implementing financial literacy programs at home is crucial to ensuring that children have the tools they need to navigate the complex financial landscape. Whether your kids go to public school, private school, or homeschool, financial literacy has been left on the back burner. By providing children with age-appropriate financial education, we can help them develop good financial habits and avoid costly mistakes. With the right resources and support, we can empower the next generation to make informed financial decisions and build a secure financial future.

The Importance of Financial Literacy for Children

I strongly believe that financial literacy is an essential skill that every child should learn. It is not just about understanding how to manage money, but also about making informed decisions that can impact their future financial well-being. Learning to buy assets young will have a compounding effects on their future and set them up for the financial challenges ahead. In this section, I will discuss the importance of financial literacy for children and its benefits.

Early Financial Education Benefits

Teaching children about financial literacy at an early age can have numerous benefits. It can help them understand the value of money, budgeting, and saving. It can also help them develop healthy financial habits that they can carry into adulthood. It can help them to acquire assets. By learning about financial literacy early on, children can avoid making costly mistakes and develop a sense of responsibility towards their finances.

Curriculum Development and Integration

Implementing a financial literacy curriculum is the first step in implementing a financial literacy program. The curriculum should be age-appropriate and cover topics such as the fiat money system, the value of money, how to build assets, the difference between consumer debt and asset related debt. They need to learn that simply saving their money will lead to less money due to inflation. Parents must integrate financial literacy today to protect the future of our children.

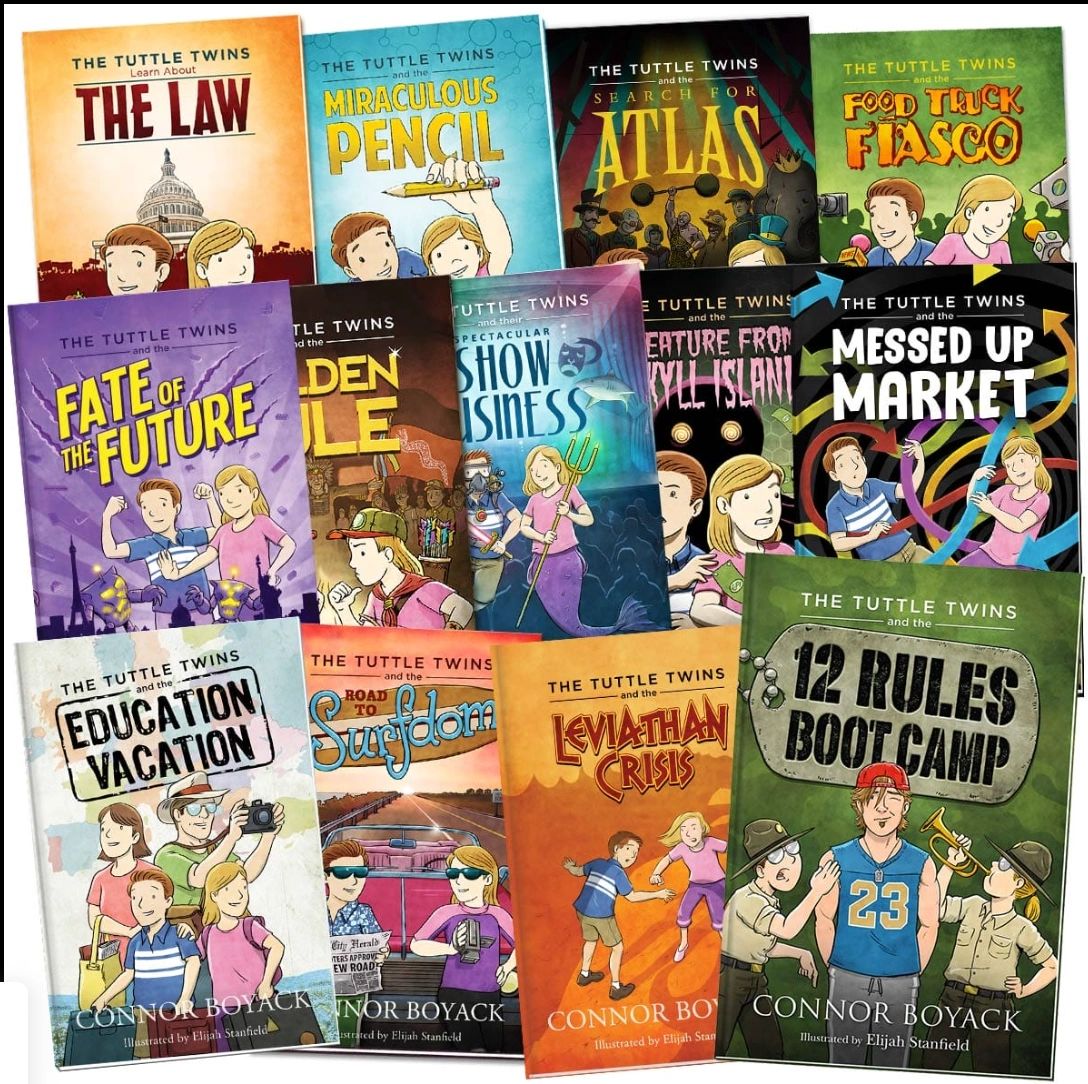

There are a couple of financial literacy curricula that I would recommend for kids ages 8-12. The first is the Tuttle Twins books that go over everything to do with money from fiat currency to inflation. The other curriculum that I would recommend are Economic Cycles and If You Made a Million by Moving Beyond the Page.